How to learn Journal Entries Easily

In two-way recording system accounting activities start with Journal. So to say, Journal is the first step of the Accounting Recording System. So it is important for us to learn Journal Entries. In order to…

In two-way recording system accounting activities start with Journal. So to say, Journal is the first step of the Accounting Recording System.

So it is important for us to learn Journal Entries. In order to learn journal entries easily first of all we must have an idea about Accounting Equation.

An accounting Equation is a basic formula that shows that The Total assets of an organization always equals the Total liabilities.

The basic accounting equation formula is :

A=L+OE

Where A=Assets

L=Liabilities

OE=Owners Equity

One side action of the Formula always affects the other side. If there is an increase in assets that means there is an increase in Liabilities too. And a Decrease in Assets always causes a decrease in Liabilities.

For example, You brought in Cash to start your Business.

There is an increase in Cash (Assets) and also an increase in Capital (Owners Equity). Another Example, You took a loan from Bank. There is an increase in Cash(Assets) and Loan (Liabilities).

The extended form of the Accounting Equation is:

A=L+C+R-E-D

Where,

- A=Assets

- L=Liabilities

- C=Capital

- R=Revenue

- E=Expenses

- D=Drawings.

How to Create a Journal Entry in Accounting

Accounting Equation always makes understanding Journal Entries easier. And, Second of all we must see the Effects of the transaction.

Some Transactions increase the Assets, Liabilities, Expenses etc and some decreases them. Then we must identify the two sides (Debit and Credit) of the transactions.

There is a chart of Debit and Credit for effects of a transaction.

| Increase | Decrease | |

|---|---|---|

| Asset | Debit | Credit |

| Liabilities | Credit | Debit |

| Capital | Credit | Debit |

| Revenue | Credit | Debit |

| Expense/Drawings | Debit | Credit |

Here are a few examples for your better understanding, I hope, you understand easily

Example 1: Salary Expense 10000 tk.

Here, Salary is an Expense account for which the increase of Expense is Debit and Cash is An Asset for which the decrease of Asset is Credit.

So, You can write it like this:

Salary expense- Debit

Cash- Credit.

Example 2: Cash Sales 50000 tk.

Here Cash is an asset so as Cash increased it will be a Debit account.

And Sales is a Revenue for which increase of Sales will be Credit account.

Cash- Debit

Sales- Credit

You can try many other examples too.

How to Prepare a Journal

Create a Table for Journal

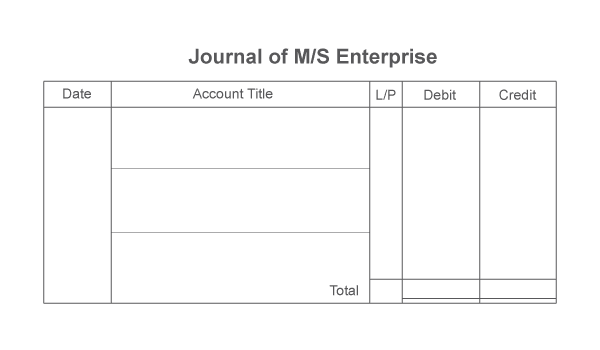

A Journal consists of five main Columns. They are:

- Date of the Transaction

- Account title and description and debit and credit side in a different line

- Column for Ledger page No

- Debit amount

- Credit amount.

The table of the Journal is shown below:

Write a Journal Entry

We have already learnt a Journal consists of five columns, the next step is to prepare and write a Journal Entry. There are few steps you will have to follow:

- Select the transaction that occurred

- Identity the and effects of the transaction

- Write the date of the Transaction in the Journals Date Column

- Write the Accounts Tittle and Particulars of the transaction. Also, write two sides (Debit side and Credit side) of the Transaction.

- Write the Ledger Page No in which the transaction is recorded in the Ledger book account.

- Write the Debit amount of the transaction.

- Write the Credit amount of the transaction.